News & Media

Making Sense of the Newest OZ Bill

Pending Legislation Would Update, Enhance Opportunity Zones for Investors

By Clint Edgington

While partisan political battles in Washington command the headlines, Opportunity Zones have quietly earned bipartisan support in Congress, and there are proposals pending to strengthen OZs to make them more accountable, transparent and attractive to investors.

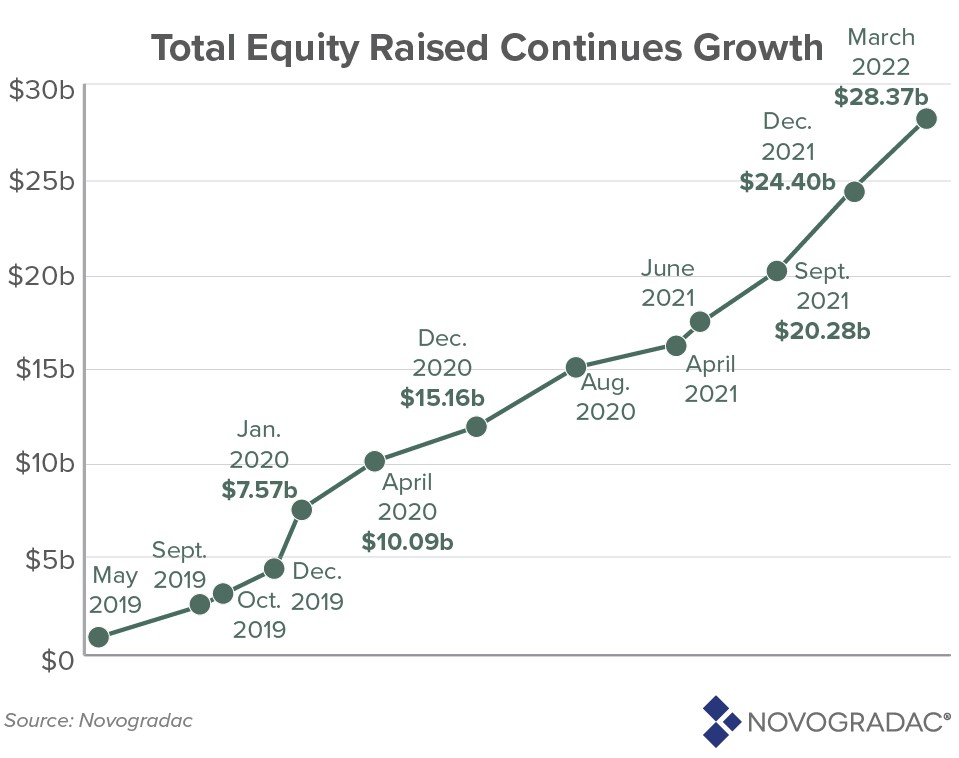

The attractive tax benefits of an investment into a Qualified Opportunity Fund seems to be incentivizing the flow of capital into these lower income areas. Capital flowing into QOFs was predictably torrid, as Dec. 31, 2021 was the deadline to achieve an additional 10% reduction in taxes. What I found surprising, however, was that investment appears not to have slowed down.

This investment is intended to “spur economic growth and job creation in low-income communities.” At Nest, we’ve created quality, affordable housing in OZ-designated neighborhoods in Columbus, Ohio, and Lexington, Kentucky. Success stories in places like South Los Angeles, Baltimore and Erie, Pa. have emerged across the country.

Legislation in Congress

Congress is now considering the Opportunity Zones Transparency, Extension and Improvement Act, introduced with bipartisan support in both chambers of Congress in April. Senate Bill 4065 was co-sponsored by Democrat Cory Booker of New Jersey and South Carolina Republican Tim Scott. Ron Kind, a Wisconsin Democrat, and Mike Kelly, a Pennsylvania Republican, sponsored HR 7467, the parallel House version. Hearings are pending in the Senate Finance Committee and the House Ways and Means Committee.

Jimmy Atkinson, the founder of the OpportunityDb website, a deep database of resources for OZ investors, is among the leaders of an advocacy push to urge Congress to pass the Opportunity Zone bill.

“I think it hits the sweet spot between not doing enough and going too far,” said Atkinson, who also offers podcasts, seminars and numerous other tools to help the OZ investment community. He said he’s finding broad support for the bill from two key stakeholder groups: community development leaders and the investment community.

“I support the bill,” said Andrew P. Doup of Kegler Brown Hill + Ritter in Columbus, Ohio, who has worked with the Nest fund and specializes in OZ investments. “It proposes to fix four of the biggest flaws in the current law.”

Following are some of the bill’s key provisions:

Extend Investor Incentives

More complicated to enact than originally envisioned, it took two years for the feds to finalize regulations. The bill would extend the deadlines an equal amount of time, which could encourage more investors and help communities maximize the benefits of OZs. In particular:

- Dec. 31, 2028, would be the new Opportunity Zone deadline to defer cap gains into a fund, rather than the current Dec. 31, 2026.

- Investments into a QOF would again have a 10% reduction in capital gains tax on original asset sold. While the reduction in capital gains taxes on the original asset sale is a much smaller benefit than the eventual tax-free exit of an investor’s QOF interests, we’ve run the math and it adds to the return of a typical QOF by about 0.5%. Download our personalized calculation tool for a better idea of what that might mean for you.

“For investors, developers and community stakeholders, extending it by two years is just going to guarantee a lot more capital flowing into the program,” Atkinson said.

Create Pathways for Smaller-Dollar Investments

A qualified opportunity fund (like Nest) that bundles investor dollars to fund projects in specific OZs also could be organized as a “fund of funds” to invest in other such funds. The goal is to make financing more readily available for OZs involving smaller communities or smaller projects.

More Accountability & Transparency

A small number of OZs weren’t deployed in truly impoverished areas. The legislation would sunset OZ status for tracts with higher median family income, while honoring OZ benefits for investments already underway in those tracts. States could replace zones they sunset with new, eligible communities. The law also would close a procedural loophole to improve tracking and reporting of long-term outcomes in communities that get OZ investments.

Doup said that the additional reporting requirements make sense “so that policymakers can measure whether an OZ is achieving its public policy purpose.” Atkinson agreed, noting that “for the most part, it’s going to help paint a better picture that this is working as intended.”

For the OZs that may have been defined inappropriately, both experts agreed that it makes sense to close those off while grandfathering current investors so they aren’t penalized.

More Support & Assistance

A “State and Community Dynamism Fund” would create flexible grants to help states do a better job of driving capital to underserved businesses and communities.

“I’m probably most excited about the establishment of a $1 billion fund for social impact projects,” Doup said. “States would have the authority to suballocate funds to local governments and nonprofits, which could use the funds to pay for things that often serve as a barrier to entry for private investment, such as professional services and predevelopment costs.”

The Future of the Program

If anything, Doup would like to see Congress go further someday and extend OZ benefits to “afford OZ income tax treatment on investments of all pre-tax income and not just income taxable at capital gains rates.”

To learn more about pending OZ bills in Washington, visit this link at Congress.gov.

State legislatures are active as well. For example, Senate Bill 225 passed the Ohio State Senate in February and is pending in the Ohio House Ways and Means Committee. The bill enhances OZ benefits for investors in the Buckeye State’s Opportunity Zones by expanding eligibility for investment tax credits to include those who aren’t Ohio taxpayers, increasing investment tax credits that can be claimed during 2022-23 and making it easier to transfer tax credits. You’ll find a detailed bill analysis at this link.

As always, we welcome your questions and comments. We can analyze in detail what the current law and proposed changes could mean for you. You can email me or get more information or fill out our contact form.