Fund Information

Navigating You Through Opportunity Zone Investments

“Qualified Opportunity Zones” (OZs) were created by Congress in late 2017 with passage of the “Tax Cuts and Jobs Act.” This program offers deferral of initial capital gains tax owed, reduction of capital gains tax owed and elimination of capital gains on new investments. The Nest Opportunity Fund® is an Opportunity Zone investment program designed to offer these unique tax incentives while doing great work for the communities involved.

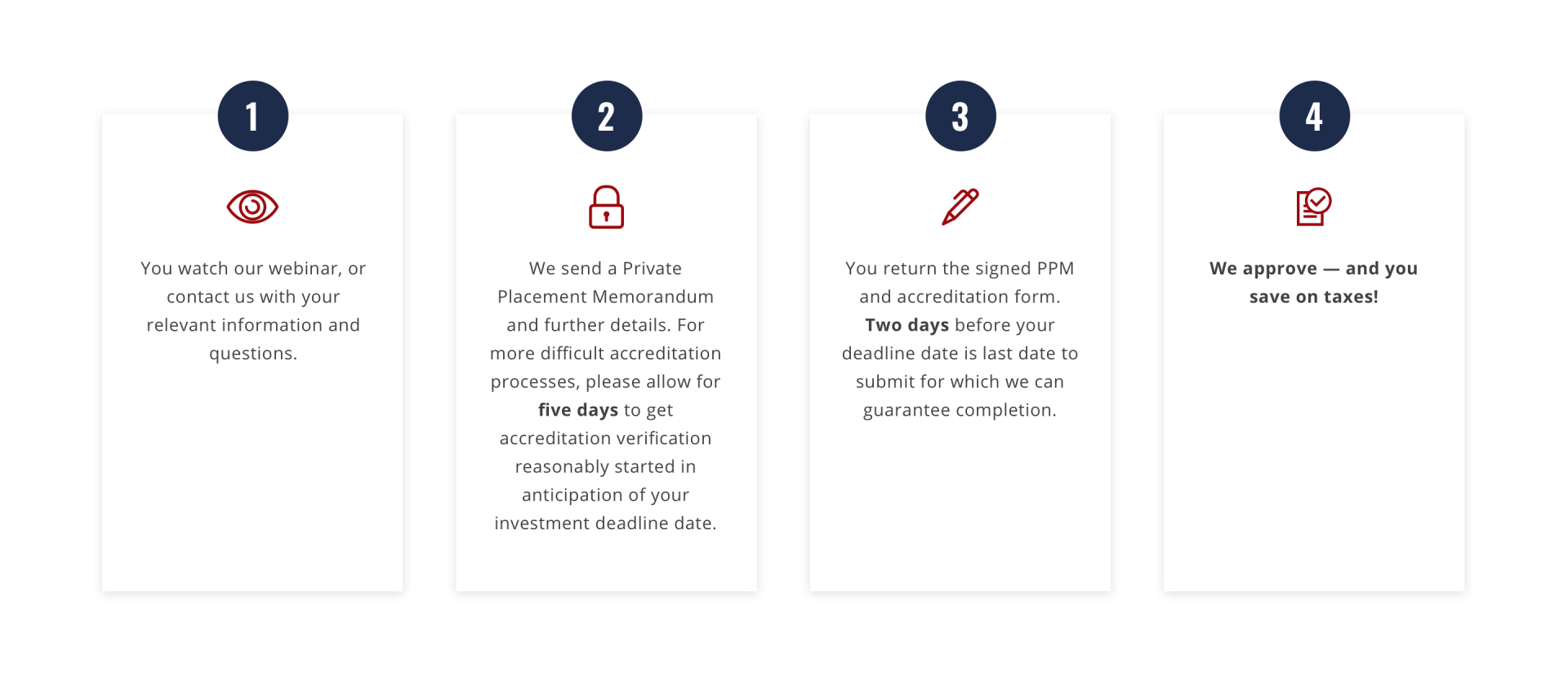

What Does the Investing Process Look Like?

For Investors: Timelines, Charts & Benefits

The benefits of Opportunity Zones are clear and attractive: defer the payment of capital gains taxes owed now, and not owe taxes on any Nest Opportunity Fund® capital gains if held for 10 years. The fund’s strategic investments need to make sense for both investors and the communities involved. We break down the specific investor benefits and dig into the details of the under-invested communities The Nest Opportunity Fund® is designed to support.

Learn MoreFor CPAs: Guides, Resources & Deadlines

Opportunity Zones are a developing area with complexities specific to the program and individual investors. To bridge any knowledge gaps and make the lives of CPAs a little easier, we have compiled a number of helpful resources, links, downloads and guides.

Learn More

Stay Informed About The Nest Opportunity Fund®

If you’re looking to stay informed on the fund’s latest news and developments, simply sign up for our quarterly newsletter and follow the progress!