For Investors

The Big Opportunity: How The Nest Opportunity Fund® Will Work For You

Defer payment of capital gains taxes owed now, and never pay capital gains taxes on the investment in The Nest Opportunity Fund®.

The Incredible Benefits for Investors:

Initial Tax Benefits & Deadlines

A profit resulting from the sale of an asset is typically taxed at a maximum capital gains rate of 20%. However, taxpayers now have the option of deferring payments of that tax until year-end 2026 by reinvesting those profits in an Opportunity Zone.

*Congress dictated that all capital gains are eligible, but unique situations could vary based on the taxpayer’s individual circumstances. A CPA who specializes in Opportunity Zone rules and effects could help mitigate any potential risks.

Capital Gains Tax on Fund Elimination

If the investment is held for at least 10 years, then the sale of the Opportunity Zone fund will be treated by the IRS as 100% tax-free.

Continued Appreciation

While OZs are scheduled to expire by year-end 2028, investments made prior to this expiration date will continue to accrue tax-free gains until 2047.

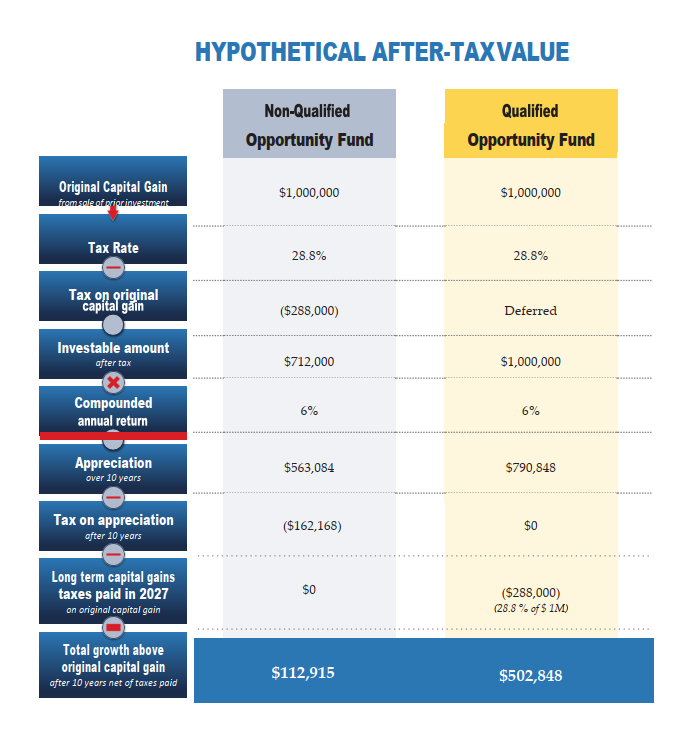

A Hypothetical: What The Nest Opportunity Fund® Could Look Like For You

On July 1, 2022, Ivan sells his S Corp business for a $1 million profit. His total tax liability is $288,000, assuming:

- A 20% long-term capital gains rate

- A 3.8% Medicare surtax

- 5% in state taxes

Instead of paying this tax to the IRS on his 2022 return, Ivan invests his profits into the fund.

Here’s How His Situation Could Play Out

In this simplified example, Ivan has maximized the Opportunity Zone tax benefits and received $389,993 in additional benefits.

Upgrading the Standard of Living While Maintaining Character & Culture

The Nest Opportunity Fund® doesn’t exist to build empty warehouses or luxury hotels in Opportunity Zone neighborhoods. While our primary goal is to serve under-invested communities, our operators on the ground are dedicated to improving property values and providing high-quality homes while preserving the existing culture and personality of the community.

More sustainable homes. More neighbors. More people enjoying each other and their city!

The 1% Down Payment Credit: Our Economic Development Partnership With the City of Lexington

The Lexington City Council has established an Opportunity Partners program designed to improve neighborhoods by providing high-quality, affordable housing, along with an easy pathway to homeownership through Qualified Opportunity Zone funds in Kentucky. To bolster these efforts, eliminate financial barriers and supplement The Nest Opportunity Fund’s® work on the ground, the program offers tenants with good payment history a 1% down payment credit for each year they rent the home.

How The Nest Opportunity Fund® Meets The “Substantial Improvement” Requirement

All Opportunity Zone investments are required to meet a “Substantial Improvement” requirement to enjoy the above-listed benefits. This requires that the cost of renovations must at least equal the cost of purchase, minus the land. The Nest Opportunity Fund® primarily focuses its efforts on improving single-family residences. Because we seek to improve dilapidated, vacant structures and upgrade them from the ground up, our renovation efforts easily meet this threshold.

Have additional questions about The Nest Opportunity Fund® & how it could help expedite your progress toward accomplishing your financial goals?