News & Media

It’s Better Late Than Never

How 2019 Capital Gains May Still Be Eligible for Deferral by Year-End 2020

By Clint Edgington

In response to COVID-19, the IRS has granted extensions[1] that enable taxpayers to defer payment of their capital gains tax liability by investing capital gain proceeds into a Qualified Opportunity Fund by year-end 2020.

In doing so, the IRS has opened the door for taxpayers to reach back to capital gains realized in 2019 and defer those proceeds by investing into a QOF prior to Dec. 31, 2020.

Summarized Table of Eligible Dates for Deferral

| Party realizing gain | Party investing/deferring Qualified Capital Gains | Earliest date of realizing Capital Gain that is still eligible | Tax Year of Returns where deferral must be indicated | Deadline to invest in QOF |

| Taxpayer | Taxpayer | 10/4/2019 | 2019 | 12/31/2020 |

| Passthrough Entity | Passthrough Entity | 10/4/2019 | 2019 | 12/31/2020 |

| Passthrough Entity[3] | Taxpayer | 1/1/2019 | 2019 | 12/31/2020 |

To achieve this goal, the taxpayer must either amend their timely-filed 2019 annual return or, if the taxpayer elected for an extension, simply elect for deferral on their 2019 annual return on or before Oct. 15, 2020[2].

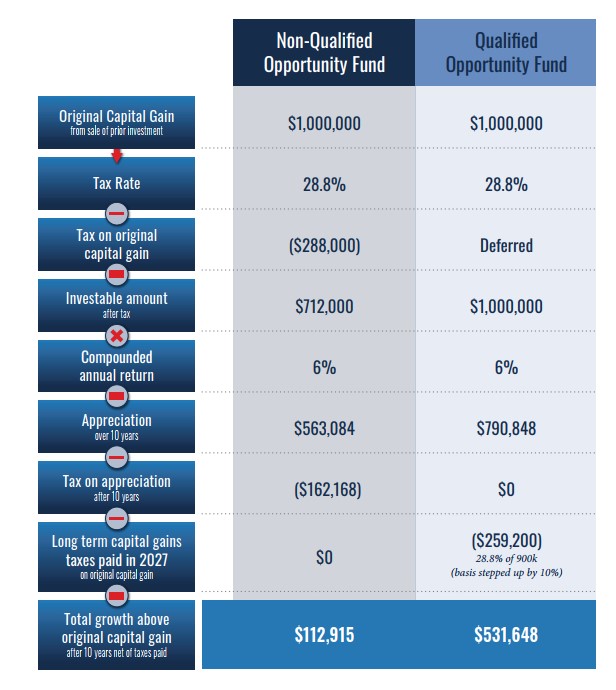

In accordance with the Opportunity Zone rules, a timely deferral into a Qualified Opportunity Fund (QOF) would not only provide deferral of a maximum 23.8% tax rate in 2019, it would also result in a 10% tax break in 2026 and a 100% tax-free gain on the tenth anniversary of the taxpayer’s QOF investment.

For a review of your specific circumstances, please contact us for a brief call.

[1] IRS Notice 2020-39 states that “If the last day of the 180-day investment period within which a taxpayer must make an investment in a QOF in order to satisfy the 180-day investment requirement falls on or after April 1, 2020, and before December 31, 2020, the last day of that 180-day investment period is postponed to December 31, 2020. This relief is automatic.”

[2] The taxpayer must make a valid deferral election per the instructions to Form 8949, complete Form 8997 and timely file the two forms with a timely filed Federal income tax return for the taxable year in which the gain would have been recognized.

[3] Most entities will fall in this category. For various approved methodologies, see our post here.