FAQ

Need additional information on qualified Opportunity Zone funds or the operations of our fund? See below for answers!

What are a Qualified Opportunity Zone (QOZ) and Qualified Opportunity Fund (QOF)?

A QOZ is an economically distressed community where new investments by a QOF, under certain conditions, may be eligible for preferential tax treatment. These designated areas cover the entire country and vary widely in their economic and geographic characteristics.

A QOF is an investment vehicle that has been certified as either a partnership or corporate federal income tax return in is organized for the purpose of investing in QOZ property.

What Is The Biggest Advantage Of The Opportunity Zone Program?

The biggest advantage of the Opportunity Zone program is the potential for tax-free growth. If you hold your investment for at least 10 years, any appreciation on the asset is entirely tax-free when you sell. This makes it a powerful tool for building long-term wealth while supporting the revitalization of economically distressed areas.

What Are The Benefits Of Buying A Property In An Opportunity Zone?

Buying a property in an Opportunity Zone offers significant tax benefits, including the ability to defer capital gains taxes, reduce the amount of capital gains owed through a step-up in basis, and potentially eliminate taxes on any new gains from the investment if held for at least 10 years. Additionally, investing in Opportunity Zones can generate long-term returns while contributing to the economic growth of underserved communities.

What type of projects do you invest in?

- Assets: Residential real estate through single family and smaller multi-family properties. For a review of some of our projects, click here.

- Location: We are focused on Midwest cities with favorable demographics that include stable and diverse employment, population growth and other criteria, including favorable pricing and rent. Currently, we are focused in Columbus, OH and Lexington, KY. If you want to learn more about our current projects, please request our latest Deck.

Why single family and smaller multifamily?

- Generally, residential is a more conservative real estate asset than other commercial properties. In particular, regarding scale, smaller scale projects’ future value depends much less heavily on interest rates than larger multifamily. If interest rates move up in the next 10 years, larger multifamily properties will have a hard time appreciating.

- From an operations perspective, these rehab projects are quicker and require less visibility on what the world will look like in 10 years. Folks will always want housing in 10 years.

- It’s what we know.

Ready To Invest?

Join our investment fund, defer your capital gains tax, and transform a community in the process.

What is your purchase strategy within your markets?

We generally buy the toughest (and cheapest) properties on a street in order to improve the neighborhood.

We generally underwrite our purchase offers to achieve a project-level projected target annual return of 15% and to generate cash flow with prudent leverage. There can be no assurance that our projections will materialize. Please see our private placement memorandum for projections and assumptions.

What are your goals to help strengthen communities?

We believe the path to the middle class and strong neighborhoods is paved through homeownership, but a down payment is the speed bump for that. For a portion of our properties, we’ve created a pilot program to help with this. If they rent from us for 5 years and have a good history, they receive a 1% reduction in the appraised value for per year of rental history. This acts as a down payment. Our investors aren’t harmed, as we don’t have to pay typical brokerage fees. Hopefully, this will turn tenants into homeowners and allow them to invest in their future.

How are you doubling the cost basis of each asset?

The properties we buy are normally vacant and require significant rehabilitation. We are outbid quite often, as we generally assume we’ll have to replace everything and, this way, we don’t encounter a lot of nasty surprises. Typically, we are taking these down to the studs. Once you’ve reviewed our PPM and have an interest in investing, we’ll be happy to share our OZ testing.

What are the fees associated with your fund?

Please contact us and request a PPM for full discussion on fees. Essentially, there’s a 1.5% asset management fee on net assets per year. Investors then receive:

- 4% preferred distribution annually on their investment and a full return of their capital;

- For remaining profits, investors get 85% and the General Partner receives 15%;

- Additional fees: In addition, for any debt we personally guarantee, there is a 0.75% guarantee fee on the loan balance per year. There is no acquisition, project level, disposition, etc. fees. The fund does not reimburse us for office and employee overhead.

What if capital gains taxes go up?

As the regulations are currently written, you will pay tax on your original assets capital gain in 2026 at the then-current rate. While this would reduce the benefits to an OZ investment, assuming rates stay the same, the tax-free exit in 10 years becomes more attractive. Request a personalized calculation for a clearer picture of how this might look for you.

What’s The Status On Your Properties?

We update the status of our properties on a monthly basis. Request our deck here for more information.

Can I invest if I don’t have capital gains?

Yes, we have both OZ and non-OZ units. For the portion of your investment that is not a capital gain, you will not receive the additional tax benefits, though you will otherwise participate in the economic benefits.

Does your fund have a minimum investment?

Our minimum investment is $200,000. We may make exceptions, and we invite you to discuss it with us. Due to our regulatory structuring, our fund is limited to 99 investors, and we need to maintain efficiency for our partners.

Do you intend to leverage the real estate?

We use a prudent amount of leverage. Our target leverage is 65% LTV, which is relatively low for our more stable asset class. This will fluctuate. Our smaller assets’ size is generally considered more conservative than larger real estate projects and can handle more leverage. Please contact us and request a PPM for full discussion on leverage.

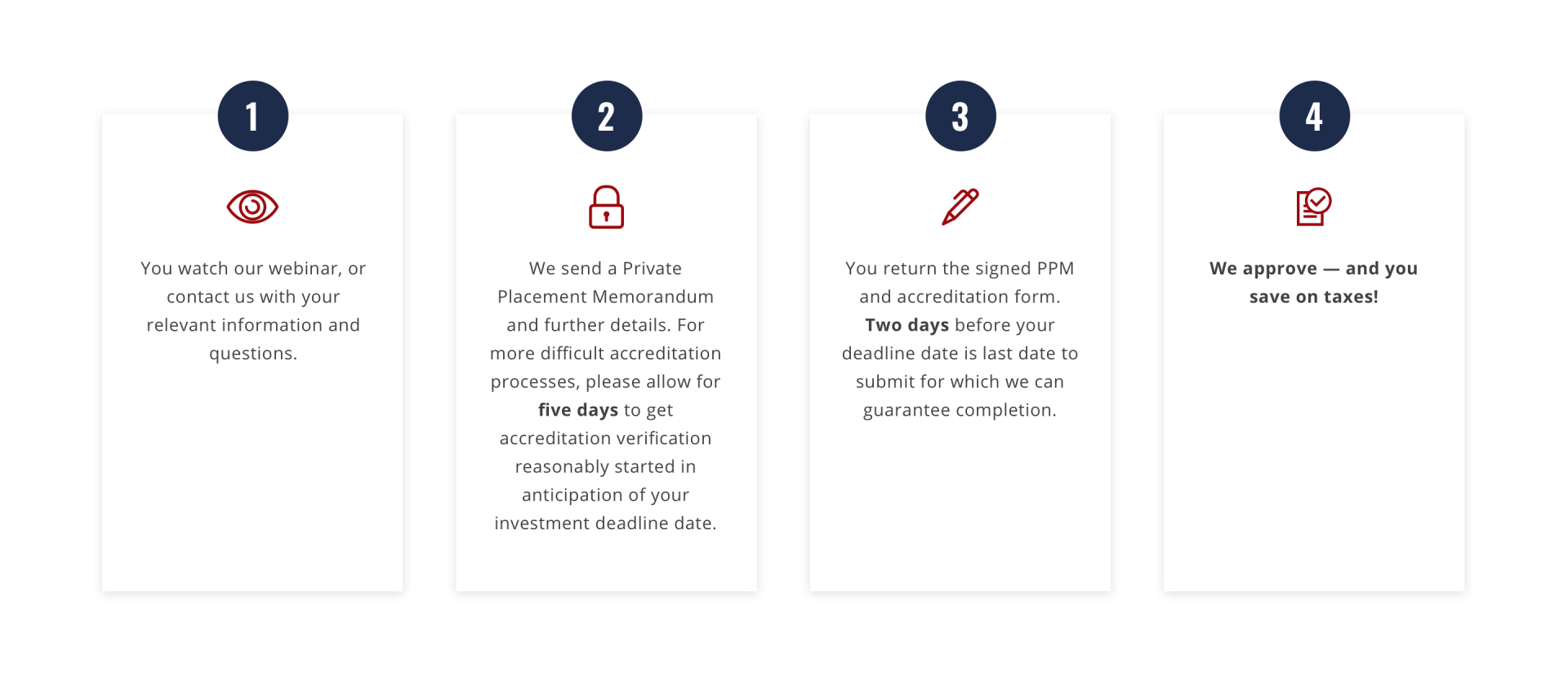

I’m unclear as to when my deadline to invest would be. Do you have any resources?

Yes, we have several resources to help investors determine their deadline to invest. We will create a timeline with you to make sure your paperwork is completed and you are approved as an investor in order to save on taxes. Contact us to set up a 15-minute call to review your situation and provide you with more tailored resources for your investing needs.

Is It Too Late To Invest In An Opportunity Zone?

No, it’s not too late to invest in an Opportunity Zone. While the program’s initial deadlines for certain tax benefits have passed, the most valuable benefit—tax-free growth on new gains after a 10-year holding period—remains available. Many Opportunity Zones continue to offer strong growth potential and attractive long-term returns.

What is your expectation for distributions?

Nest offered its partners a vote on whether to begin preferred distributions in 2020. All investors wanted to maintain capital in the fund in order to increase the future tax-free capital gains. We anticipate paying back all or a portion of the preferred distributions in 2026.

What if I want to let my gains continue to build after 10 years?

We anticipate allowing investors to stay in the fund if they would like; however, we cannot guarantee it now, not knowing what financial markets will look like at that time.

Can the fund sell properties within the initial 10-year period without generating capital gains liability?

If Nest sells properties within the fund in the first 10 years, that capital gain will be taxable to investors. While that is not our intent, there will likely be instances of that occurring. We would intend to distribute cash in the amount needed to offset any tax liabilities.

Where can I find additional information?

- Contact us.

- Review our latest Deck that discusses our fund.

- Download our Opportunity Zone white paper.

How do I invest in your fund?

It’s easy! Click here to invest or call us with additional questions (614-469-4685). We can review your current situation and objectives to determine if Nest Opportunity Fund is a good fit for your investing needs!