News & Media

Coronavirus Impact Part I

Hard assets offer advantages in tough times

Editor’s note: This is the first of three blog posts to help you analyze the economic impact of the coronavirus pandemic on investments in Opportunity Zones, such as Nest Opportunity Fund. Hard assets such as real estate can be good harbors for investment in times such as these, but, of course, you should proceed with due diligence. This is something we can help you assess with no obligation. We invite you to contact us.

By Clint Edgington

We’ve never seen anything like this. COVID-19’s impact on the financial markets and the real economy has been severe, prompting a historically fast and dramatic response by the Federal Reserve, Congress and the president.

How Have Different Assets Fared?

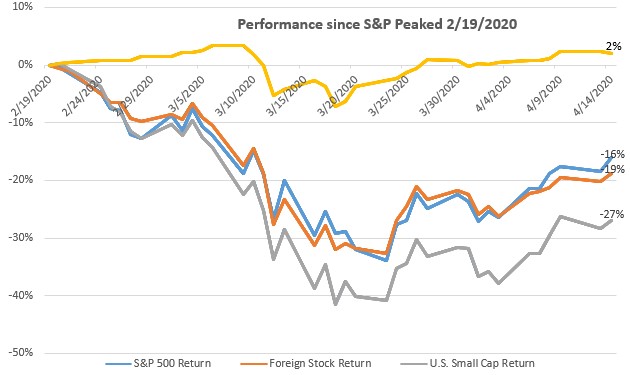

The market recently experienced its fastest 10% drop from an all-time high in history, and Wall Street now is anxiously awaiting quarterly earnings reports that likely will show major declines in profits, and even big losses. As is normally the case in such downturns, bonds are generally holding their own, though it’s important to note that not all bonds are created equal. The status of lower-rated corporate debt is much different than U.S. government debt.

“Quick containment” of the pandemic will likely bring what’s called a V-shaped recovery due to leverage in the private sector and among banks, supported by the super-sized fiscal and monetary stimulus the federal government has enacted. If this happens, it will be a major departure from the 2008-09 downturn. However, real damage will still occur, particularly in sectors such as entertainment, travel, oil and gas. There will be negative results in many other sectors, but with losses that could be manageable.

A longer shutdown of large aspects of our economy will spread wider and deeper. The shape will be more like a “U” or even an “L,” not a “V.”

The Best Comparison

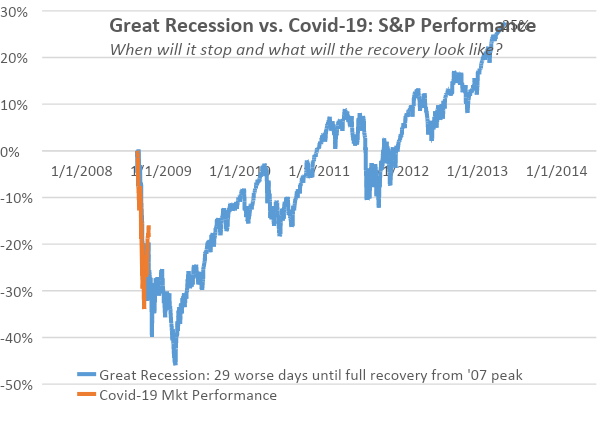

Although this comparison has limitations, our best comparison might be to the great downturn of 2008-09, brought on by the collapse of mortgage debt. However, the start of the market slide during the Great Recession isn’t the right time to begin the analysis.

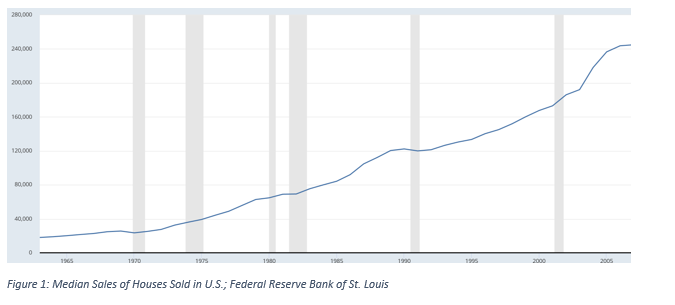

Looking back, we know now that the market started to slide in late 2007. It wasn’t so obvious then. Only New Century Financial, a risky mortgage broker, had failed. Data showed that single-family houses still had not lost money in any single year nationwide.

Then, in March 2008, Bear Stearns was forced to sell at a bargain price to J.P. Morgan, and the markets reacted. On Sept. 15, 2008, when Lehman Brothers suddenly declared bankruptcy, we knew we were in trouble.

So, let’s began our analysis on Sept. 12, 2008, when we were sure there was trouble, and place that over the top of the 29 trading days since Feb. 20, 2020, when it became clear the coronavirus was going to hugely impact the economy. It’s not a perfect comparison, but you can see how things might look for us.

So, if the economy has a similar experience to 2008, equity holdings might fall another 25%. For a balanced portfolio with 60% stock and 40% bond, that would be another 15-20% loss. An “L-shaped” recovery took four years to happen. We’re more optimistic than that, as the next section explains.

How Might Real Estate Fare?

Note that we entered 2008 with high leverage across both our banking and real estate sector – and a deleveraging was in order. The dramatic government actions taken this year should maintain adequate leverage to help the economy start faster.

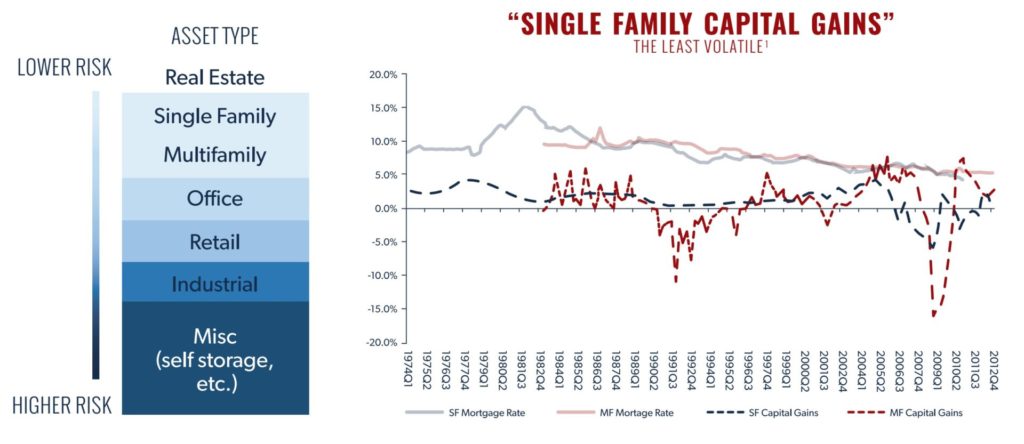

That could be a good sign for investors in some areas of real estate. After all, real estate is not the cause of this downturn, unlike the last one. But real estate recovery could be uneven, with particular negative impact in the areas of commercial, hospitality and retail. Single-family residential owners have challenges, too, of course, but residential property rehabs are continuing around the country. Even including the 2008/2009 recession, single-family housing has generally been more stable than most other investments.

Builders will likely slow the supply of new housing, setting us up for increasing rents after the initial storm blows over. While we wish this harm on no one, due to luck more than skill, this storm affects us less than most, as our rehabs should become cheaper, still being in purchasing mode, and a lot of dry powder.

“Tax Alpha” Is Forever

Opportunity Zone Funds are longer-term investments. In essence, you are allowed to defer and minimize capital gains taxes, often very significantly, by investing in the OZ. Your original capital gain will be reduced by 10%. At a 28%[1] total capital gain tax rate, that’s an automatic 2.8% return. That capital gain is deferred until 2026 as well, but the largest benefit is that gains on the OZ investment will be tax-free. This “tax alpha” has nothing to do with the returns of the S&P 500. So, in the current environment, an Opportunity Zone investment might be a good harbor for funds for which you can have a time horizon of several years. Check out our calculator to see if this option is right for you.

Resilient Communities Provide Stability

Our Nest fund is focused in the residential sector, providing improved housing stock to communities such as neighborhoods in Columbus, OH and Lexington, KY, where we are actively investing. We have selected these cities not only due to our location, but also due to their relatively stable workforces, as they are both state capitals and university towns. This combination of the relatively stable housing sector and diversified local economies makes for a good place to be.

Cash Is King in a Downturn

Nest Opportunity Fund is currently sitting on cash and looking for deals. Even after we deploy our cash, we intend to maintain very low leverage on our real estate so we have the flexibility to make future downturns profitable for our investors.

Interested in a deeper dive into the historic actions of the Federal Reserve to address the pandemic and its impact on the economy? You’ll find more from Clint Edgington on the blog page of Beacon Hill Investment Advisory.

—

Clint Edgington is co-founder of Nest Opportunity Fund and leads the investment team at Beacon Hill Investment Advisory. Beacon Hill provides advisory and family office services to business owners to simplify their financial lives, including their businesses, their retirement plans, and their public and private investment holdings.

Beacon Hill works with a business owner’s team of tax, M&A and legal professionals to evaluate and invest, in a tax-efficient manner, in private and direct investments – primarily focused on private debt, direct real estate, and small- to middle-market buyout and equity investments.

Clint has been admitted as an expert and testified before the National Association of Securities Dealers (NASD), New York Stock Exchange (NYSE) and Financial Industry Regulatory Authority (FINRA) on his analyses of portfolios and securities. He has also acted as trustee and administrator in a corporate role for 401(K)s, Profit Sharing Plans and defined benefit Pension Plans. As a plan fiduciary, he has managed brokers, evaluated the performance of money managers and managed other vendor relationships for ERISA-based plans.

He has been published or quoted in the Chicago Tribune, the Columbus Dispatch, the Journal of Financial Planning, Plan Sponsor Magazine, CNBC and other publications. In addition, he serves as the Chairman of the Columbus CFA Society Private Wealth Committee.

Clint graduated with a B.S. from Miami University with a major in Economics. He resides in Grandview Heights with his wife, Jenny and sons, Cole, Grant and Connor.

—

Nest Opportunity Fund is an Opportunity Zone (OZ) investment program designed to not only do well for investors, but also do good for those in the communities targeted for fund investments. “Qualified Opportunity Zones” (OZs) were created by Congress in late 2017 with passage of the Tax Cuts and Jobs Act. This program offers deferral of initial capital gains tax owed, reduction of capital gains tax owed and elimination of capital gains on new investments. Our leadership team performed extensive research to select which type of under-invested Opportunity Zones will benefit from our engagement. We chose single-family homes and smaller multi-family homes because they present a lower risk to investors while maintaining the culture and character of the neighborhoods. We partner with thoroughly-vetted, regionally-respected contractors who specialize in managing multiple property upgrade projects at once. These homes are built to last, complete with solid wood cabinets, upgraded appliances, tankless water heaters and a catalog of other amenities to help improve the lives of residents and ease our management of them.

[1] 20% Federal capital gains tax rate, 3.8% Medicare Surtax and 5% estimated state tax.